Important Steps to Protecting Your Retirement

|

Watch a quick video to learn about our

"Rock Solid Retirement Income Strategy". Peace of mind that comes with retirement income that's guaranteed to last as long as you do! |

|

About Us |

|

Laura Sturm | Licensed Independent Broker

At Senior Educational Advocates, we help aging individuals protect their finances from out-of-pocket costs related to Medicare enrollment, retirement allocation safety, and downside protection. Our educational approach ensures that each client's needs and concerns are addressed with care and dedication, making a positive contribution to society.

Laura Sturm, a licensed Senior Educational Advocate in Texas since 2006, is also a Senior Transition Specialist who can help retirees make informed decisions about Social Security benefits, Medicare, and retirement protection in volatile markets. With our expertise, we can optimize your lifetime income while minimizing risk. NSSA® Advisor Certificate Holder

|

|

Our Services

What We Do For Clients |

|

Asset Protection

Retirement doesn’t mean that it’s time to stop growing. Same holds true for your money. It should mean, however, that it’s time to stop taking unnecessary risk.

We specialize in helping retirees protect their retirement assets while continuing to move forward. |

Family Legacy Planning

Many of our clients want to leave a legacy for their children and grandchildren and are shocked to learn how easy it is to double, even triple their inheritance – TAX-FREE AND GUARANTEED!

We also work with our clients and help them embrace their own mortality and be prepared for the loss of a spouse and the income burdens this can often create. |

|

Extended Care Solutions

Long-term care/extended care costs have gone up substantially in the last 10 years. Unfortunately, the statistics are not in our favor, a plan to address these costs should be included in every retirement strategy.

The good news is we work with hybrid insurance plans that leverage your dollar in case you need it for extended care, but remain 100% accessible for withdrawal if you don’t. |

Retirement Income

Creating an income plan to last throughout retirement is perhaps the single most important challenge retirees will face. It’s very likely to spend 30 years or more living in retirement without earned income.

We create a customized retirement income plan, encompassing all sources of income, for each one of our clients and no two plans are exactly alike. Let us get to work on a plan for you. |

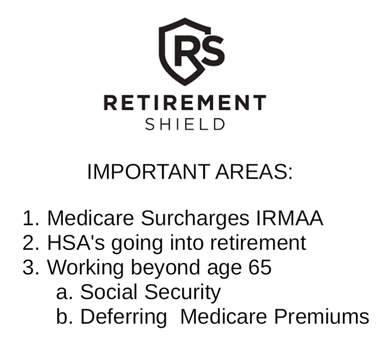

Understanding Medicare

"What you don't know about social security and medicare timing could be surprising financially."

Workshops and virtual seminars are available

"What you don't know about social security and medicare timing could be surprising financially."

Workshops and virtual seminars are available

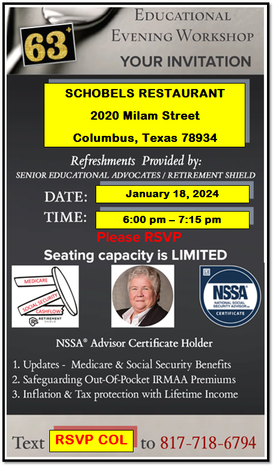

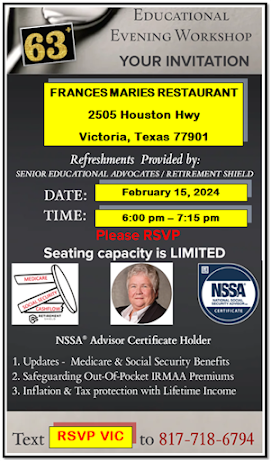

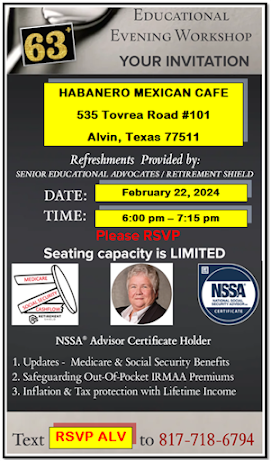

Educational Events

|

|

|

We Love To Meet New People!

Contact Us

|

|

|